It should be noted that this will always be tailored to the specific requirements of each transaction. There are a number of stages involved in the securing of insurance terms and the placement of an insurance policy.

#Cleanexit how to

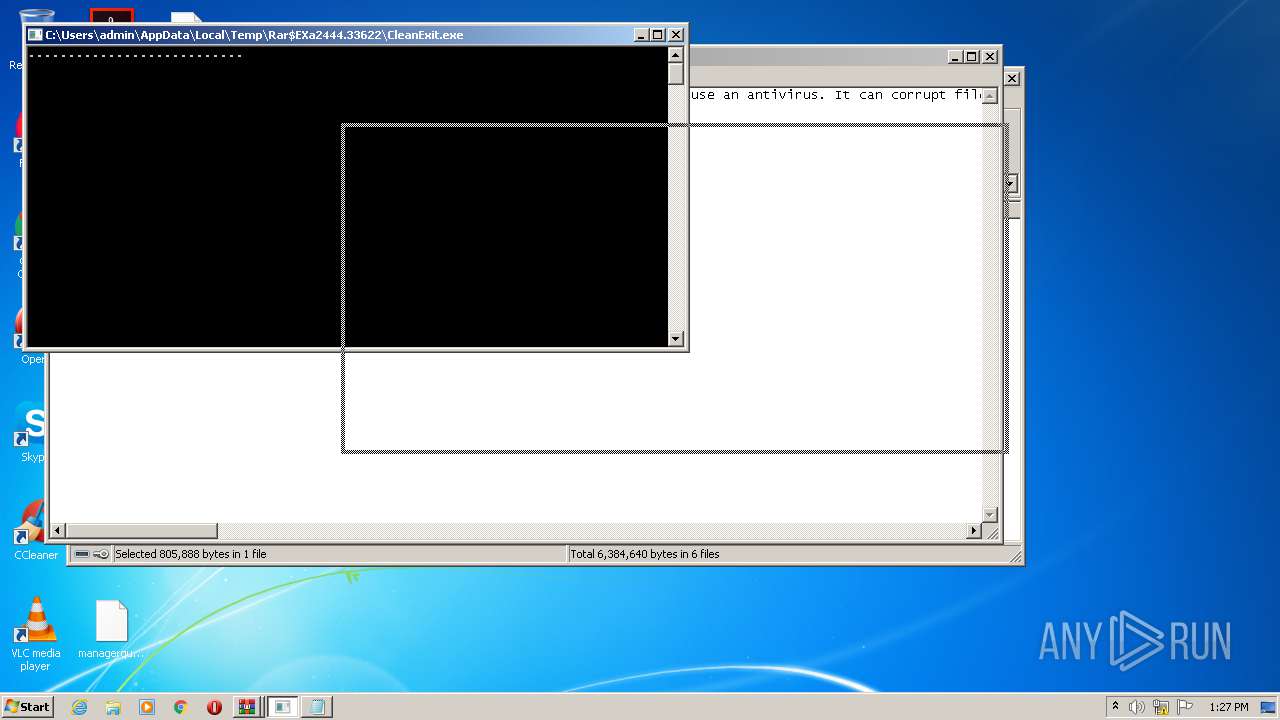

Learn how to set up and run automated tests. No requirement for the buyer to pursue the warrantors before claiming under the policy. Use the cleanExit method in your next Playwright Internal project with LambdaTest Automation Testing Advisor.The policy provides protection over and above a policy excess, typically set at around 0.5% of enterprise value (“EV”).

Sellers and/or management give the warranties (and a tax indemnity) in the normal course but are typically able to cap their liability, often at £/€/$1.A failure by the parties to reach agreement on liability apportionment can adversely impact the transaction making negotiation difficult, affecting the target’s value, or leading to deadlock.Ī seller-initiated buyer warranty & indemnity (“ W&I”) insurance policy is the tool of choice for bridging this gap in the expectations of the parties. A seller will typically resist having to tie up sale proceeds or have any residual liabilities post completion.

0 kommentar(er)

0 kommentar(er)